In both life and trading, the adage “life is 10% what happens to you and 90% how you handle it” holds profound truth. As we delve into the world of trading, it becomes evident that the sequence of events, be it losses or gains, can significantly impact our emotional response and perception of success. This paradoxical nature of trading prompts reflection on the psychological aspects that drive our decisions and influence outcomes.

The Quirks of Trading Psychology: Winning Breakeven and Losing Happy

Consider the peculiar scenarios often encountered in trading. A trader commences the day with two consecutive losing trades, digging a 2R hole, only to claw back to breakeven by day’s end. Surprisingly, there’s a sense of satisfaction despite the absence of monetary gain. Conversely, imagine a day that starts with a 2-0 or a 2-3R lead, only to give it all back, concluding the day at breakeven. Strangely, this outcome is met with disappointment. The question arises: Why does the order of events influence our emotional response, even when the financial outcome remains the same?

The Illusion of Outcome Sequence in Trading

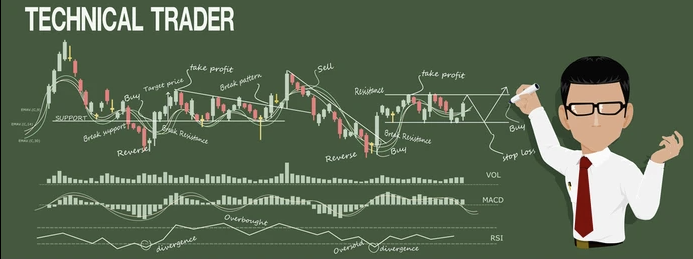

The illusion lies in the significance we assign to the order of events. In the grand scheme, the sequence should be inconsequential. If one takes quality trades on both days, the financial result becomes a manifestation of probabilities, beyond the trader’s control. Traders, fundamentally, are ‘ODDS TRADERS,’ relying on technical patterns to discern the probable direction of stocks or markets. However, the interplay of emotions clouds this rational perspective.

Emotional Resilience: The Core of Trading Success

In the realm of trading, where uncertainty prevails, emotional resilience becomes paramount. The ability to weather losses without succumbing to tilt or emotional distress is a hallmark of seasoned traders. It is here that the true challenge lies – conquering emotions that often wield greater influence than market dynamics. Psychology emerges as the linchpin, constituting a staggering 99% of success or failure in this demanding profession.

Constructing a Fortress of Emotional Discipline

For traders grappling with emotional upheavals, a strategic approach to psychological fortitude is imperative. A robust consequence system, coupled with an accountability partner, emerges as a potent solution. The consequence system acts as a self-imposed disciplinary measure, enforcing accountability for actions and decisions. This self-regulation mechanism serves as a powerful deterrent against emotional impulsivity.

Conquering Emotions: The Role of Accountability Partners

The accountability partner adds an external layer of checks and balances, ensuring adherence to the established consequence system. This ally becomes the guardian of discipline, offering objective perspectives and support during challenging moments. Collaboratively, the consequence system and accountability partnership create a fortress of emotional discipline, mitigating the detrimental impact of impulsive decisions.

The Road to Trading Success: A Psychological Odyssey

In the intricate tapestry of trading, the 10-90 rule takes center stage. Success is not solely dictated by market acumen or technical prowess but by the mastery of one’s emotional landscape. The journey to trading success, akin to a psychological odyssey, demands a profound understanding of oneself. Embrace the paradox, recognize the illusion of outcome sequence, and cultivate emotional resilience through disciplined measures. In the end, trading is not just about what happens to us but, more significantly, about how we handle it. Happy trading!