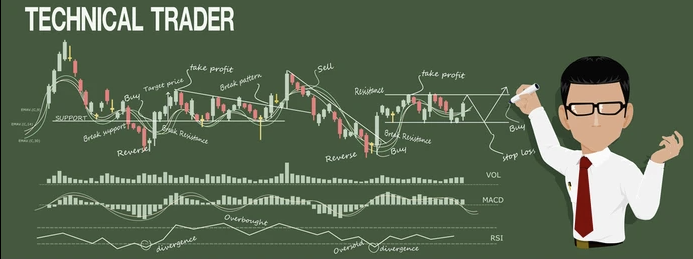

At Live Traders we don’t base our decision-making process on news, upgrades/downgrades or fundamental information. We use charts, period. I trust you all agree on that, or you probably wouldn’t be reading this blog post. But the sole fact that someone can read a chart doesn’t make him/her a trader. Only charts display the constant interaction that exists between supply and demand. This interaction creates price movements which are displayed as trends. But if you want to understand what Live Traders trading really is, we need to go deeper into this subject.

The market is the combined interaction of all investors, traders, speculators, market makers and similar entities. Their interaction creates price patterns that are nothing but the combined thought pattern of all those entities. Most of the time, those “thought patterns” or mass reactions tend to be erratic and will present us with a picture of uncertainty. But as stated in mass psychology works, some of these mass reactions tend to be repetitive and reliable enough so as to be interesting to us. Imagine someone yelling “fire” in a movie theater full of people. I’m willing to bet that more than 50% of the time, people will scramble for the exists, trampling each other in order to escape. That is an identifiable pattern of “fear”, which can be considered reliable. Now imagine someone getting to the top of the tallest building in town and throwing packs of $100 bills. I’m willing to bet that more than 50% of the time, there’s going to be a riot in the street level adjacent to such building. And these reactions will likely repeat themselves in Tokyo, New York or any other city in the world. This is because such reactions are very human.

In the markets, there are also many of such patterns that display the major emotions of fear and greed. Some of these “events” display moments in time when one of the emotions, say fear, has been in place for a number of periods, and then gives way to greed (or vice versa). Out of all such “events” there are but a few that under the right circumstances will tend to produce a suggested price move. Our job as traders is to define some of those “high odds” events, then define the strategy to follow in order to trade them, understanding that some of those events will produce the suggested move and some won’t. Then, our job is to establish a proper position and money management system, so that we can maximize the profits obtained from the successful outcomes, and minimize the losses from the unsuccessful outcomes. Sounds easy? It’s not. There are additional factors that affect the outcome of these events. Factors such as the psychology of each trader, which affects his actions and therefore his results, and the overall market environment (market internals), which as we’ve discussed in previous articles is key to determine the odds of most setups.

The majority of problems plaguing most traders stem from not understanding deep in their hearts all the implications of the above ideas. You can name any reason. You don’t take your stops? It’s probably because you don’t understand this activity for what it is. An odds “game”. If you understand that each trade can work or not work, you will use stops. Don’t have a trading plan? The same holds true. Every mistake a trader makes is a product of not understanding Professional Trading Strategies (PTS) concepts. Once you get to fully understand the above ideas and their implications to trading, you can begin to erase many of your trading mistakes.