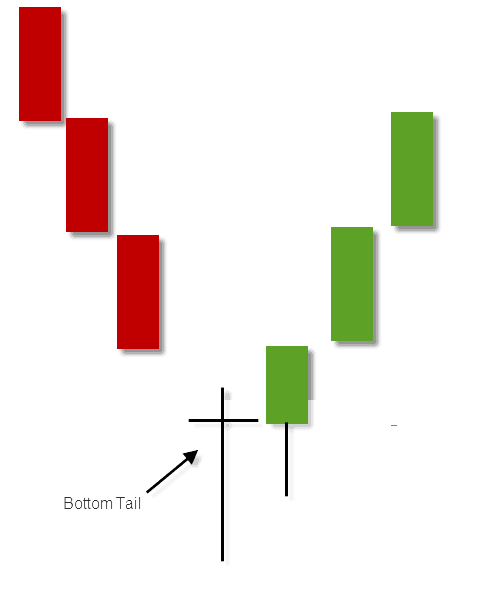

Bottoming and topping tails are my favorite pattern enhancers. They can even be used as patterns on their own as discussed in the article. However, that should only be done with experience. In the article I talk about bottoming tails, but everything discussed can be applied for topping tails, in reverse as well.

As you know candlestick charts are an essential tool in technical analysis, providing valuable insights into chart trends and price movements. Within the charts, various candlestick patterns convey important information about market sentiment and potential reversals. One such pattern is the bottoming tail, which can offer significant indications of a potential bullish reversal. Understanding the importance of bottoming tails and their interpretation can greatly enhance your ability to make informed decisions and capitalize on profitable trading opportunities. In this article, we will delve into the significance of bottoming tails on candlestick charts, exploring their characteristics, identification, and the various strategies and considerations associated with utilizing them effectively in technical analysis.

Bottoming tails can indicate the potential reversal of a downtrend. They are characterized by a small body located at the top of the candlestick and a long lower shadow or tail that extends below the body. This formation suggests that sellers pushed the price down, but buyers regained control and pushed it back up, signaling a possible shift in momentum.

A bottoming tail consists of three key components: the body, the upper shadow, and the lower shadow. The body represents the difference between the opening and closing prices. In the case of a bottoming tail, the body is typically small or non-existent. The upper shadow represents the difference between the high of the candlestick and the top of the body, while the lower shadow represents the difference between the bottom of the body and the low of the candlestick.

Bottoming tails are highly significant because they indicate potential price reversals and can serve as entry or exit signals. When a bottoming tail forms after a downtrend, it suggests that buyers are stepping in and could potentially drive the price higher in the future. This information is valuable for looking to capitalize on upward price movements and catch trend reversals early.

The formation of bottoming tails can be attributed to psychological and behavioral factors in the market. As prices decline, investors may perceive the asset as undervalued, leading to increased buying interest. Additionally, short sellers who initially pushed the price down may start to cover their positions, adding further upward pressure. The behavior of traders contribute to the formation of bottoming tails and highlight the importance of understanding market psychology.

The length and shape of bottoming tails provide important clues about the strength and significance of potential price reversals. Longer tails indicate stronger buying pressure and have greater predictive power. Ideally, a bottoming tail should have little or no upper shadow and a long lower shadow, emphasizing the dominance of buyers and the potential for an imminent uptrend.

Volume plays a crucial role in confirming the validity of bottoming tails. Higher-than-average volume accompanying a bottoming tail suggests increased buying interest and adds credibility to the potential reversal signal. Conversely, low volume may indicate a lack of conviction and decrease the reliability of the pattern. You should pay attention to volume trends and assess the overall market activity when interpreting bottoming tails.

Support and resistance levels are important reference points in technical analysis, and their interaction with bottoming tails can enhance the reliability of signals. When a bottoming tail forms near a strong support level, it strengthens the case for a reversal and provides you with a solid entry point. Conversely, if a bottoming tail occurs near a robust resistance level, caution should be exercised as the likelihood of a successful reversal may be lower.

Remember, while bottoming tails can offer valuable insights into market reversals, they should not be relied upon in isolation. It is important to consider them alongside other technical indicators and tools to make well-informed trading decisions.

Bottoming tails are powerful indicators of potential trend reversals in the market. These candlestick patterns appear at the bottom of a downtrend, suggesting that buyers have stepped in to reverse the downward momentum. The long lower shadow of the bottoming tail signifies that sellers have tried to push the price lower, but buyers have managed to regain control and push the price back up. This reversal in price action can often lead to a change in the overall trend.

In addition to indicating trend reversals on their own, bottoming tails also serve as confirmation signals for other reversal patterns. For example, if a bottoming tail forms in conjunction with a bullish engulfing pattern or a double bottom formation, it strengthens the probability of a trend reversal. These combinations provide you with increased confidence in your decision to enter a trade, as the bottoming tail acts as a validating factor for the reversal pattern.

Bottoming tails not only help identify potential trend reversals, but they also assist you in pinpointing entry and exit points. When a bottoming tail forms, it suggests that the price has reached a significant support level, making it an opportune time to enter a long position. Conversely, when a bottoming tail appears after a prolonged uptrend, it may indicate a potential exit point for taking profits and protect gains. By paying attention to the formation of bottoming tails, you can make more informed decisions about your entry and exit strategies.

One of the simplest trading strategies involving bottoming tails is to use them as standalone signals for trading opportunities. When a bottoming tail forms, you can enter a long position, expecting a potential trend reversal. To enhance the effectiveness of this strategy, it is advisable to combine bottoming tails with other technical analysis tools to further validate the signal and increase the probability of success. My favorite strategy is when a bottoming tails forms right at a trend line on high volume on a 5- or 15-minute chart.

When trading based on bottoming tails, it is essential to establish an appropriate stop loss and target levels to manage risk and maximize profits. Placing a stop loss below the low of the bottoming tail can help protect against potential losses if the trend does not reverse as expected. Target levels can be set based on key resistance levels or previous highs, ensuring that profits are secured once the price reaches a predetermined target. Always test any management that you choose to use.

While bottoming tails can be valuable indicators, they are not infallible, and false signals can occur, especially on lower time frames such as the 1- or 2-minute chart. You should be cautious and consider other technical analysis factors before making trading decisions solely based on bottoming tails. Additionally, whipsaws, where price reversals are short-lived and result in losses, can also occur. It is crucial to understand these limitations and manage risk accordingly by using appropriate risk management strategies to protect against potential losses.

In conclusion, bottoming tails play a crucial role in technical analysis and can provide valuable insights into market or stock reversals. By understanding their characteristics, interpreting their significance, and incorporating them into trading strategies, you can enhance your ability to identify potential entry and exit points with greater accuracy. However, it is important to acknowledge the limitations and risks associated with bottoming tails and to use them in conjunction with other technical indicators for a well-rounded analysis. By harnessing the power of bottoming tails, you can gain a competitive edge in the market and improve your overall trading performance.

Do you need help working through your weakness? Then consider joining my coaching group “Live Trader’s Coaching Group” here at Live Traders. We can help you with all aspects of trading including trading plan development, sharpening technical analysis skills, patience, discipline or mindset and of course presence. One on One coaching is also available. Why struggle on your own when you can work with 30+ likeminded traders? More information can be found at the following link:

https://livetraders.com/groups/sales/2b144965-1248-4117-a8e0-be3f70c5725d