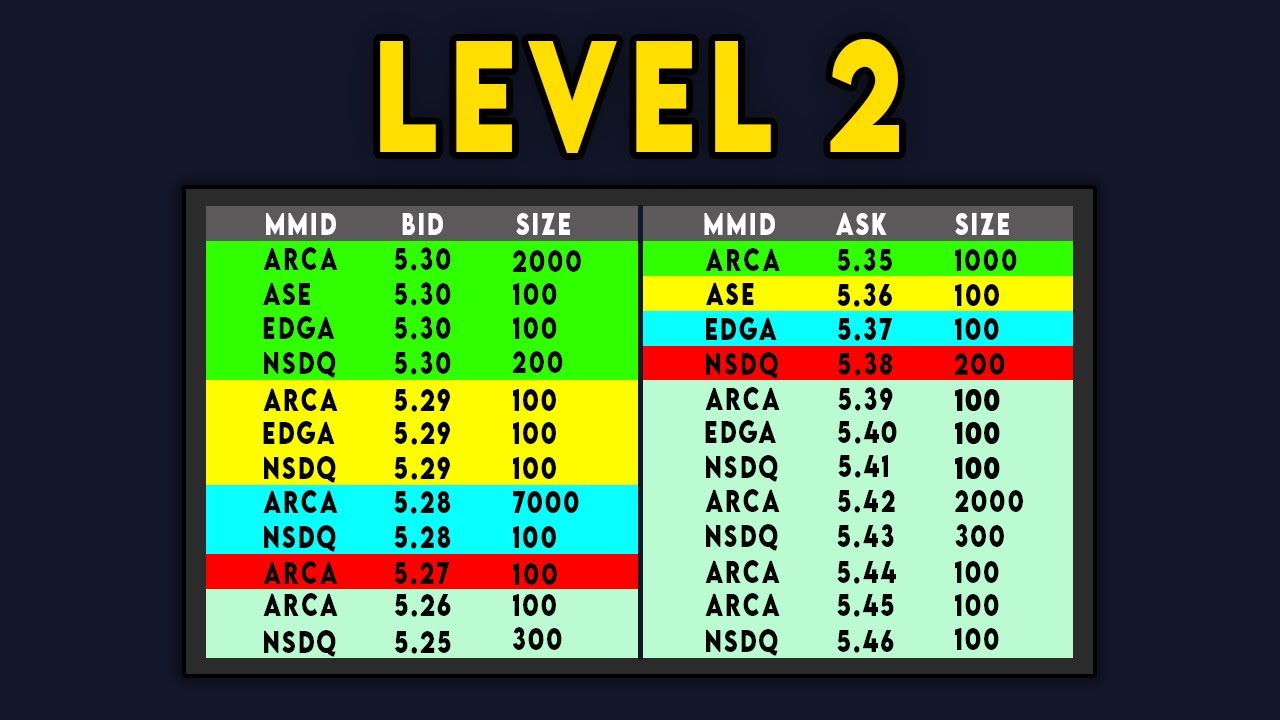

In the fast-paced world of trading, where split-second decisions can spell the difference between profit and loss, having a comprehensive understanding of Level II data is a non-negotiable asset. This article aims to explore the pivotal role of Level II and elucidate why it’s a critical tool for traders, especially in the context of slippage, skippage and not getting taken advantage by the pro’s and HFT’s.

The Essence of Level II Data

Level II provides traders with real-time insight into the order book, displaying the current bids and asks for a particular security. For traders immersed in the fast-paced world of stocks, comprehending the dynamics of Level II is akin to possessing a roadmap that guides them through the labyrinth of market movements.

Unveiling the Importance of Level II:

- Understanding Market Participants:

- Benefit: Identifying where buyers and sellers are clustered.

- Impact: Allows traders to anticipate potential price movements based on the order flow.

- Revealing Stock Spread:

-

- Benefit: Displays the difference between the highest bid and the lowest ask.

- Impact: A tighter spread signifies a more liquid market, aiding in precise entries and exits. A wider spread means you need to consider how ‘early’ you might want to enter the position so you don’t get skipped. The wider the spread the harder it is to get filled at your desired price.

- Assessing Stock Volatility:

-

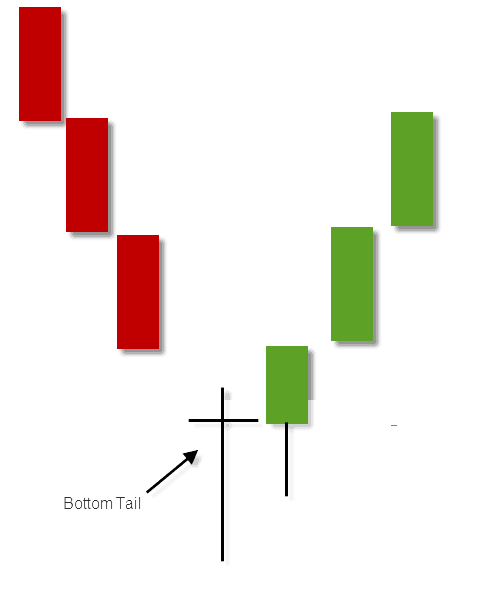

- Benefit: Reflects the volatility or “whippiness” of a stock.

- Impact: Helps traders gauge the potential for rapid price fluctuations and adjust strategies accordingly. Whippy stocks can be challenging to trade because they move around so quickly, not easily traded for newer traders. You really need to be careful with very whippy stocks, especially careful to get your protective stop loss in early in case it ‘whips’ against you.

- Enhancing Entry Fills:

-

- Benefit: Prevents getting skipped on trades, ensuring better entry fills.

- Impact: Mitigates slippage risks, a crucial aspect for optimal trade execution. If you can understand the liquidity, spread and whippiness of a stock, then you are well equipped to get the best fill possible. We treat stocks with 50 cent spreads a lot differently than we treat stocks with a 5 cent spreads. Sometimes we need to anticipate the ideal entry or try to get filled within a larger ‘range’ to ensure we get the necessary shares we need. There is great nuance to understanding Level II.

- Strategic Exit Planning:

-

- Benefit: Aids in formulating exit strategies, especially when large block orders appear. If you know there is a huge SELL order 10 cents before your target you might want to consider getting some or all of your shares off before your actual target in case the stocks cannot overcome the large block order.

- Impact: Facilitates informed decisions on profit-taking or adjusting positions based on order book dynamics.

- Efficiency and Profitability:

-

- Benefit: By understanding the competitive landscape, trading becomes more efficient. You’ll get better fills, which means targets become closer. You’ll ensure you get ‘all’ of the share you’re looking for and you also won’t get skipped. This is also important for getting better fills on stop losses.

- Impact: Promotes profitability by aligning strategies with the prevailing market conditions.

Live Traders Chat Room: A Hub for Real-Time Learning

In the Live Traders Chat Room (LTCR), traders engage in discussions about Level II data and witness real trades executed live. This interactive space serves as an invaluable resource for traders seeking practical insights into the application of Level II in the dynamic trading environment.

The Imperative of Professional Trading Education

Live Traders, a leading institution in trading education, recognizes the transformative power of Level II insights. The emphasis on Level II analysis within Live Traders courses, coupled with practical applications in the LTCR, underscores the commitment to equipping traders with the tools needed for success.

Elevating Your Trading Acumen

In conclusion, mastering Level II data is not just a skill; it’s a strategic advantage. Traders who delve into the intricacies of Level II gain a competitive edge, making informed decisions that can directly impact their bottom line. For those eager to elevate their trading acumen, exploring the Live Traders Chat Room and professional courses offered by Live Traders is a commendable step toward trading proficiency. Understanding Level II isn’t merely a choice; it’s a requisite for those aspiring to navigate the markets with precision and confidence. Happy Trading!