A question that frequently arises in our seminars is one that revolves around the success rate of various trading patterns. To this, we often pose a counter-question: What type of market are we discussing? Is it an upward-trending market, a downward-trending one, or perhaps a sideways meander? The questioner, often met with a quizzical expression, prompts us to elucidate a fundamental concept – a pattern is just one facet of a broader construct we call a setup. Allow us to delve deeper into this intricate subject.

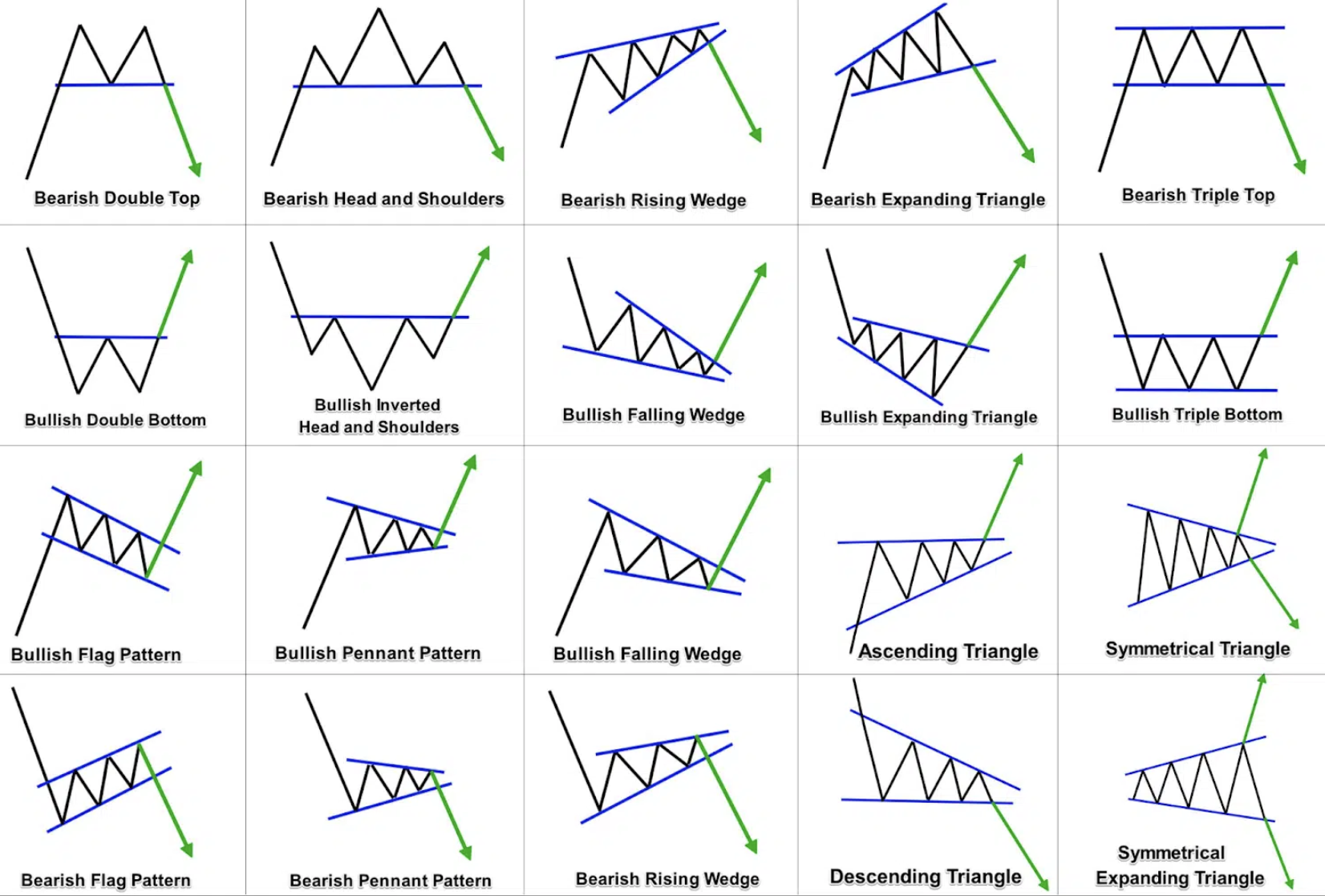

When assessing the odds associated with a particular pattern, beyond the evident consideration of its formation quality (a topic we delve into extensively in our Professional Trading Strategies (PTS) seminar), we must account for the contextual conditions enveloping these patterns. A Buy Pattern typically thrives in bullish market conditions, where its performance tends to shine. Conversely, in bearish scenarios, the vigor of a Short Pattern becomes more pronounced. This implies that in a bullish environment, patterns suggesting a resurgence of buying interest hold a higher likelihood of success. It’s important to note that no setup is impervious to failure, but the odds of a pattern materializing as anticipated are significantly elevated in favorable market conditions.

Thus, we introduce the market factor into our equation – is the broader market sentiment bullish or bearish? However, this is merely the tip of the iceberg. We must also consider additional elements, such as market internals. Do these internal market dynamics favor bullish or bearish patterns? Furthermore, the sector to which a stock belongs warrants scrutiny. The odds of a buy pattern proving fruitful in a robust sector are notably superior to those of the same pattern in a feeble sector. While either pattern may still deliver remarkable or lackluster results, discussing the likelihood of an event transpiring necessitates an evaluation of whether capital is flowing into (exhibiting strength) or out of (displaying weakness) a given sector.

In the realm of professional trading, one must train the mind to think in terms of probabilities, grasp the influence of market environments on potential trade outcomes, and adeptly employ the most fitting tools for the prevailing market conditions across various timeframes.

Explore the Live Traders Options Course for Scalping and Swing Trading Enthusiasts

For those who relish the art of scalping and swing trading, options or stocks Live Traders offers an exceptional Options Course and Stocks Course. These courses provide a comprehensive understanding of options and stock trading strategies tailored to your specific trading style. Whether you seek rapid-fire scalping opportunities or prefer to ride the waves of swing trades, our Options Course equips you with the knowledge and techniques needed to excel in these strategies. Harness the power of options to optimize your trading proficiency and navigate a diverse array of market scenarios.

In conclusion, comprehending the odds associated with trading patterns requires a multifaceted perspective that takes into account the ever-evolving market dynamics. As you progress on your trading journey, embrace the concept of probability, recognize the profound impact of market conditions, and deploy the right tools for the right situations across various timeframes. By doing so, you’ll be better equipped to navigate the intricate world of trading with confidence and precision.