Despite sharing core technological foundations, blockchain protocols differ widely in their technical implementations and feature sets. Certain specifications, such as the protocols determining how transactions on the blockchain are verified, can be optimized and customized to fit specific needs. Since Ethereum’s launch in 2015, it has been a central fixture of the blockchain ecosystem, but in 2017, Ethereum’s difficulty in meeting network traffic surges caused some to question whether Ethereum provided the best infrastructure for the growing decentralized application ecosystem.

Ethereum’s scaling issues—which can result in high fees and slow processing times—presented an opportunity for competitors to improve the user experience. Taking advantage of this opportunity, a team of cryptographers created the Algorand platform with the goal of improving on existing blockchain protocols by implementing innovative cryptographic techniques for improved security and scalability. Did Algorand have the potential to solve the blockchain scaling problem and leapfrog Ethereum to become the industry’s standard protocol?

Background

Algorand’s Beginnings

Algorand was founded in 2017 by Silvio Micali with the goal of building inclusive and transparent infrastructure for the borderless economy. Micali, an MIT professor and cryptography expert, started researching blockchain in 2015 after learning about Bitcoin. “The first time I heard about Bitcoin, I saw all the difficulties,” Micali recounted, “To me, the main difficulty is the waste of computational resources. That is really appalling. It drives up prices and depletes the planet of resources.” Bitcoin’s shortcomings inspired Micali and his colleague Nicholai Zeldavich to run experiments to test out their own design for a permissionless blockchain. They began by renting out servers from Amazon and incrementally increased the number of users until they determined that the concept had the potential to support a public network.

Micali began studying cryptography in the 1980s and won a Turing Award alongside Shafi Goldwasser in 2012 for their joint work to “make cryptography a precise science.” Together the two constructed formal notions of privacy, adversaries, pseudorandomness, interactive proofs, and zero-knowledge proofs. Micali holds over fifty patents for practical applications of his theories, and many of these cryptographic techniques were instrumental for advancing blockchain technologies.

Algorand was developed as a ‘Layer 1’ solution that offered an alternative to major decentralized networks, most notably Ethereum. Algorand contends that it provides a solution to many of the issues that plague Ethereum users, such as high transaction fees and slow transaction processing. Other potential ‘Ethereum killers’ include EOS and Cardano. As of mid-2021, Algorand has hundreds of organizations, including startups and institutions, building diverse applications on its network. As an open source network, Algorand’s technology can also be used for private or permissioned applications.

Ethereum

Conceived by Vitalik Buterin in 2013, Ethereum is a blockchain network that serves as a popular platform for decentralized applications (dApps), and in particular, for decentralized finance (DeFi) applications. In order to transact on the Ethereum network, users pay network fees, called ‘gas fees,’ with the network’s native token, Ether (ETH). The computational resources required to execute a transaction on the network are denominated in ‘gas,’ and the amount of gas required for a transaction is determined by bandwidth requirements and computational difficulty of the transaction. The price of gas, on the other hand, is determined by the level of network demand for gas at a particular moment in time. When submitting a transaction, an user indicates the maximum gas payment that they are willing to pay. If a miner is willing to execute the transaction at an equal or lesser gas fee, then the transaction is executed; if not, then transactions with insufficient gas payments are passe over by miners.

Transactions on the Ethereum network are processed by nodes that validate transactions using a proof-of-work (PoW) protocol, similar to the consensus protocol used by Bitcoin. In PoW protocols, blocks are added to the blockchain by miners who perform computations to ‘validate’ the block. Gas fees are paid to the miners as rewards for performing the computational work to validate transactions on the network. Although Ethereum still operated using PoW as of 2021, a transition to an alternate consensus mechanism called proof-of-stake was made in 2022.

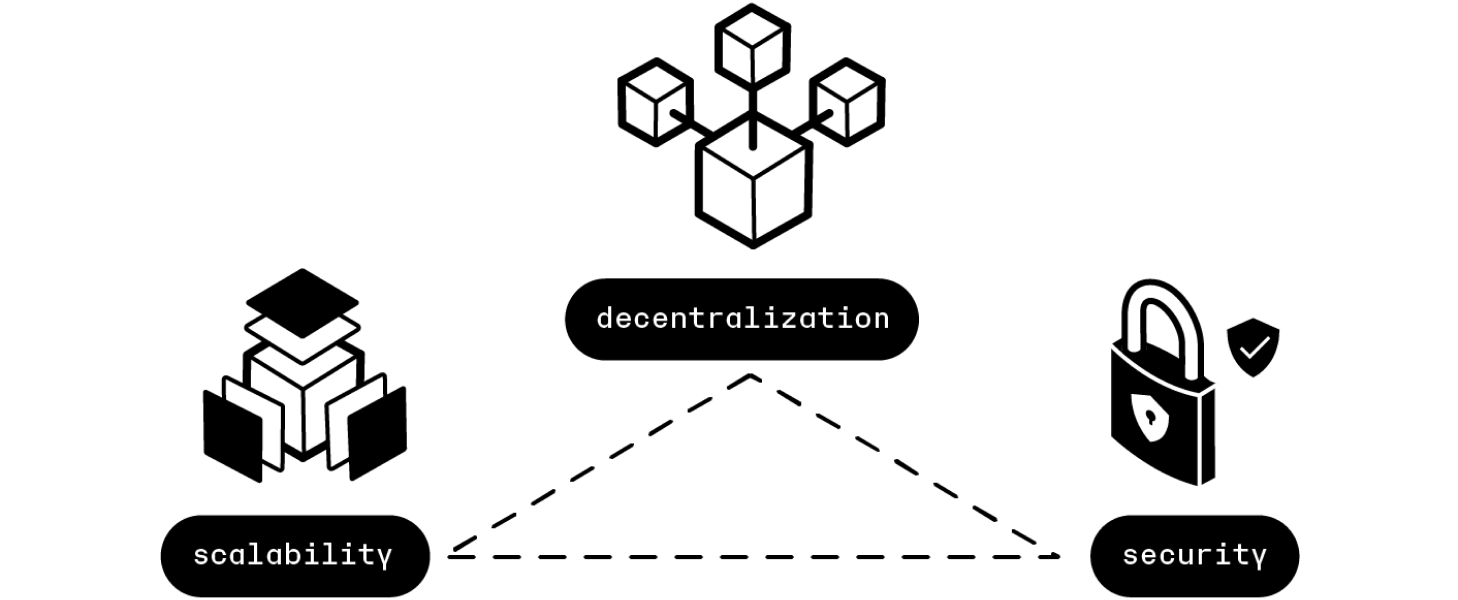

The Blockchain Trilemma

Buterin, the founder of Ethereum, argued that a blockchain could only possess two of the following three desirable characteristics: decentralization, security, and scalability. For Ethereum, the tradeoff between these features means that while Ethereum is decentralized and secure, it has difficulty scaling to accommodate its rapidly growing user base. For Ethereum, inability to scale is seen as a substantial barrier to mass adoption.

Since the period of intense Ethereum network congestion in 2017, many scaling solutions have been built to address the blockchain trilemma Ethereum faces. There are two major categories of scaling solutions: building a new blockchain (referred to as ‘Layer 1’ solutions) or building a scaling solution that works on top of an existing blockchain (referred to as ‘Layer 2’). Some of the most popular Layer 1 solutions include Polkadot and Cardano, and each formed its own ecosystem for smart contracts and dApps.

Algorand: Searching for the Perfect Protocol

Out with the Old

Micali did not set out to design Algorand simply to improve on Ethereum. Rather, Micali had a vision of how blockchains should be built and wanted to construct Algorand from first principles. “Sometimes it’s better to bring down an edifice and start from scratch than to try to patch up what’s already there,” Micali said of his experience building Algorand. He argued that while existing blockchains were sufficient for infrequent purchases, they were not ready to be integrated into the global economy.

The blockchain trilemma needed to be overcome, but the issue was not just scalability. Micali believed that many popular blockchains failed on all three dimensions of the trilemma. While many existing blockchains were notoriously unscalable, Micali was concerned that they were also insufficiently decentralized. In order to design the ideal blockchain, Micali set out to design a protocol that allowed for truly decentralized consensus. Bitcoin and Ethereum were not truly decentralized, Micali argued, since the computational complexity of Proof-of-Work validation processes made it very expensive for individuals to participate in the networks’ consensus mechanisms. As a result, the majority of transactions were verified by miners in ‘mining pools,’ the name given to groups of miners who combined their computational resources to improve their chances of mining a block. In Micali’s view, this concentration of power over the network in the hands of a few coordinated groups made these networks undesirably centralized.

Brad Garlinghouse, the founder of the cryptocurrency payment network Ripple, had made similar comments criticizing the high level of centralization in Bitcoin and Ethereum mining, and even argued that the level of concentration in these networks should be a concern for US foreign policy. In 2018, Garlinghouse argued that “Bitcoin is really controlled by China. There are four miners in China that control over 50 percent of Bitcoin.”

He reiterated this sentiment during a 2020 hearing with the SEC, saying, “[t]he Bitcoin and Ethereum blockchains are highly susceptible to Chinese control because both are subject to simple majority rule.” This claim was questioned, since the geographic base of a particular mining pool did not necessarily indicate anything about the political allegiance or even geographic location of the pool’s members. Still, Garlinghouse and Micali both identified a key aspect of major decentralized currencies: the centralization of their validators.

The idea of concentrated network control is fundamentally at odds with the spirit in which many of these projects were born. When Bitcoin was conceived by Satoshi Nakamoto, he had sought to create a truly peer-to-peer network in which individuals would mine blocks, and he had not anticipated that mining pools would form. Nakamoto had envisioned that the mining process for Bitcoin would be just as decentralized as the technology itself, with every person who owned the currency running nodes on their personal computers.In a peer-to-peer network. However, the block rewards used to compensate miners for the costs they incurred in running the network created incentives for intense competition. Miners are able to increase their chances of winning these rewards by upgrading their equipment. Mining pools allow miners to share the cost of the specialized, high-performing computers that are necessary to stand a chance against their similarly well-equipped competition. The presence of mining pools and specialized equipment makes it exceedingly unlikely that someone mining with a personal computer wins any rewards, and therefore makes it unprofitable to participate in the network in this way. This leaves only mining pools to validate transactions on the Bitcoin network, and other proof-of-work networks have been impacted by similar incentive systems that make working in pools advantageous.

Proof-of-stake (PoS), the most popular alternative to PoW, also fails to offer a fully centralization-resistant solution. PoS does not require miners to perform computational work to validate new blocks. Instead, blocks in a PoS protocol are validated by sets of users who own the network’s tokens and temporarily contribute their tokens to the protocol as collateral in a process known as staking. Many PoS networks implement slashing, which augment validators’ incentives to behave honestly; if a validator breaks the rules and accepts an invalid transaction, they lose their staked tokens. This makes attacks on the system extremely costly. Although PoS avoids some of the computational work required by PoW, it still has several issues. In PoS systems, validators still need to process all transactions and to store all blockchain data. Depending on how their data structures are designed, the required equipment can be significantly more sophisticated than a personal computer. In addition, PoS systems can lead to centralization of network power in the hands of users who can afford to buy up large amounts of the network’s tokens.

In addition to the blockchain trilemma, there are other dimensions along which the Algorand team believed blockchain could be improved. For one, the computational work required for proof-of-work consensus consumes a lot of energy, which some view as wasteful. Another downside of Bitcoin’s protocol, in the eyes of the Algorand team, is that it allows for ‘forking’, which can create multiple, irreconcilable versions of the blockchain. There are also “law-enforcement and monetary-policy concerns” surrounding Bitcoin, according to Algorand’s whitepaper. While the possibility that Bitcoin could be used for illegal activity or could disrupt central banks’ monetary policy was a plus for some in the blockchain community, the Algorand team saw this as a negative feature of Bitcoin that needed to be addressed.

In with the New

Instead of selecting an existing consensus mechanism, Micali set out to invent an entirely new blockchain structure, focusing specifically on the areas in which he felt existing blockchains had failed. First, Algorand implemented a data structure that allows a validator node to be run on Raspberry Pi, a small single-board computer that requires very little computational power to operate. In contrast to Bitcoin’s computationally-intense protocol, Algorand is designed so that users can validate transactions from a device as simple as a mobile phone. This ensures there are no hardware requirements that might prevent someone from participating in Algorand’s consensus process.

Next, Algorand wanted all token holders, not just those with access to large pools of capital, to participate in consensus. To this end, Algorand invented its own consensus protocol called pure proof of stake, which does not require staked tokens to be locked up for any amount of time. Instead, at any given point a validator’s current account balance is used as their level of stake for consensus purposes. However, the Algorand team recognizes that not all token holders may choose to participate in validation. Algorand’s PPoS simply requires users who want to participate in validation to mark their accounts as ‘online’. Then verifiable random functions, a cryptographic technique invented by Micali prior to founding Algorand, are used to select validators from online users randomly and secretly. This feature also augments Algorand’s security, since a potential adversary cannot know who will generate the next block, and as a result, does not know who to target in order to attack the network. Participation in PPoS is also fully voluntary, unmonitored, and uncompensated, with no block rewards and none of the transaction fees being paid to validators. In Micali’s view, participation in the form of supporting a node is a “form of civic service.”

In Algorand’s view, another downside of PoW protocols is the possibility that two or more blocks are approved simultaneously if multiple miners solve the same crypto puzzle, or find valid nonces for the same block, within seconds of one another. This would result in a ‘fork,’ or the emergence of two conflicting versions of the blockchain. Eventually, the fork could be resolved as future validators build onto the ‘heaviest chain’ and the competing versions would die off, but these temporary forks are cause for unnecessary confusion. An accepted transaction could end up on dead blocks and vanish, so users have to wait to see if their transaction was accepted on the winning blockchain before considering their transaction complete. Making the computational puzzle easier might speed up block times, but could also intensify the forking problem, since puzzles being mined at a faster rate means more opportunity for simultaneous blocks.

The Algorand blockchain does not allow for forking because transactions on the network are finalized immediately. In each round, a block is proposed and a set of validators votes on whether or not to add the blockto the chain. Since a majority of validators need to approve a block for it to be added, it is impossible for multiple blocks to be approved. As a result of the network’s instant transaction finality, there is no instance in which two blocks could be added to the blockchain in the same position.

Several technological innovations made the invention ofAlgorand’s protocol possible, including many that won cryptography and computer science awards for Micali and the Algorand team. Verifiable random functions are just one example of a novel cryptographic technique that was implemented in Algorand. Algorand also employs zero knowledge proofs, which were invented by Micali and used by many other blockchain projects, and its own form of Byzantine Agreement.

A Developer’s Eye View

Just like any other network, blockchains benefit from network effects: the more users there are on a given Layer 1 solution, the more valuable that solution becomes. Ethereum and its programming language Solidity had become standards for blockchain development. In order to draw developers away from Ethereum, it was not enough for Algorand to just offer an improved technology. It needed to be easy for developers who currently worked on Ethereum to move to Algorand, as well as for new developers to learn about dApps and blockchain development.

Algorand tackled this issue by offering a large suite of services for both experienced and inexperienced developers. Algorand’s developer portal has educational materials that start at the very beginning of the development process, with guides on how to build a dApp and how to tokenize an asset. In order to build on Ethereum, developers need to learn the Ethereum-specific coding language Solidity, but Algorand hoped to lower the barrier to entry for building dApps by allowing developers to write smart contracts in more commonly used languages, such as Python and Reach. Developers can also build assets using Algorand Standard Assets (ASAs), a standardized, Layer-1 mechanism for representing fungible and non-fungible assets on the Algorand blockchain. By using ASAs, developers can avoid a lot of the work involved in writing smart contracts from scratch. In addition to offering free tools and updated documentation for developers, Algorand also actively reaches out to developers to encourage them to use Algorand.

Algorand: Blockchain for the Real World

As institutions enter the blockchain space, Algorand aims to be the bridge between centralized legacy systems and the new world of decentralized technology. In comparison to traditional payment systems, like SWIFT, digital payments over Algorand are cheap and instant. The cost benefits are especially relevant for cross border payments, which can be quite expensive on existing infrastructure. Since Algorand is permissionless, there is no need for approval from a centralized entity to transact or set up contracts on the network, which cuts out the administrative costs of approving users. The decentralized nature of blockchain also makes payment networks on Algorand potentially more secure, since there is no single point of failure for attackers to target, as there is in centralized banking. Unlike other blockchain systems, which can have wildly fluctuating transaction fees depending on how busy the network is at a particular time, Algorand has a flat transaction fee. This flat transaction fee enables large transaction volumes at a predictable cost.

As a result of its security and accessibility, Algorand is used for tokenization of traditional financial assets. Algorand works with governments, central banks, and major commercial banks to tokenize a diverse range of traditional assets, such as tokenized home equities. Several major stablecoins—tokens representing fiat currency—have also been launched on Algorand. Stablecoins are a cornerstone of the crypto economy, since they serve as a means for traders to easily convert between fiat and cryptocurrencies. Whereas traders previouslyfaced substantial waiting times before their transactions cleared on Ethereum, Algorand’s instant transaction

finality eliminates this friction.

Algorand is home to stablecoins, central bank digital currencies, and a wide variety of DeFi applications. In 2019, IDEX, a leading decentralized smart contract exchange, launched on Algorand to support real-time trading. In 2020, the Marshall Islands began using Algorand as the basis of its central bank digital currency. With this project, the Marshall Islands became the first country to offer a national digital currency. Tether, the most widely traded cryptocurrency in terms of transaction value, runs on Algorand’s network, enabling USDT to be traded at speeds of over 1000 transactions per second. Centre Consortium, the provider of the other major US dollar stablecoin, also announced Algorand as an official blockchain for their USDC stablecoin in 2020. In 2021, Folks Finance, a capital markets protocol for borrowing and lending, was introduced on the Algorand blockchain.

Conclusion

Micali’s philosophy is centered around the idea that making participation in consensus easier for everyone could create a truly decentralized ecosystem capable of supporting real-time, scalable transaction infrastructure. By eschewing PoW for a more efficient consensus mechanism, Algorand has improved scalability, and thanks to the development of PPoS and the other cryptographic techniques that make Algorand possible, Algorand does this without sacrificing security. Requiring minimal equipment and token investment for validators opens participation to a wider range of users, which, in turn, fosters greater decentralization. Algorand has the potential to solve the major issue preventing widespread blockchain adoption, the blockchain trilemma, but as Bitcoin and other existing networks demonstrated, well-designed systems that theoretically address problems do not always translate into a perfect network in practice. In its initial years, the Algorand community has grown significantly and has attracted remarkable institutional engagement, but only time will tell: has the blockchain trilemma been solved?