In the exhilarating realm of trading, one mantra stands out above the rest: “The trend is your friend.” It’s a timeless adage that, unfortunately, many traders overlook or underestimate. Yet, the importance of understanding and harnessing the power of trends cannot be overstated. The market, after all, is a mosaic of individual biases and actions. At any given moment, traders and investors across various timeframes converge on charts, collectively shaping the market’s trajectory. To navigate this intricate landscape successfully, one must master the art of reading charts, deciphering trend directions, and spotting changes in those trends.

It’s crucial to shed the notion that everyone trades within “your” timeframe because, in reality, they don’t. The overall amalgamation of everyone’s sentiments and actions at any given instant forms the prevailing trend. This trend reflects whether more individuals are inclined to buy or sell at a particular time. Understanding this concept, tailored to your trading or investment timeframe, is the keystone to achieving consistently accurate trade decisions. Remarkably, numerous traders, including many who have undergone our comprehensive courses, have achieved remarkable success rates of 70% to 80% by mastering the basic principles we teach.

In today’s dynamic market environment, swift trend identification is the name of the game. The first three weeks of this year alone demonstrated the value of this skill. If you’re an intraday trader, the market’s short-term trends present daily opportunities ripe for the picking. However, if you’ve been grappling with reading market directions lately, it’s high time you invest in technical analysis training. This investment will pay dividends, not just in the short term, but over the course of your trading career.

Discover the Live Traders Trading Room and Professional Trading Strategies Course

As you embark on your journey to becoming a more astute trader, consider the Live Traders Trading Room and enroll in our Professional Trading Strategies Course. Live Traders is committed to nurturing traders of all levels, equipping them with the tools, knowledge, and mindset required to excel in the world of trading.

In the Live Traders Trading Room, you’ll immerse yourself in a vibrant community of like-minded traders who share your aspirations. Here, you’ll have the unique opportunity to learn from seasoned professionals, absorb their invaluable insights, and gain a competitive edge in your trading endeavors. This is not just a trading room; it’s a supportive network designed to empower you to make informed decisions and stay true to your trading plan.

The Professional Trading Strategies Course (PTS) offered by Live Traders is a comprehensive program tailored to provide you with the skills and strategies needed to thrive in trading. You’ll master proven techniques to identify high-probability trading opportunities, effectively manage risk, and achieve consistent profitability. With Live Traders, you won’t just grasp theoretical concepts; you’ll witness these strategies in action through live trading demonstrations.

Navigating a Market Rife with Uncertainty

As we dive deeper into the topic of trends, it’s essential to tread with caution, particularly in the current market climate. The past three days have witnessed a substantial market decline, signaling potentially more volatile trading sessions ahead. Moreover, this week is teeming with a slew of reports that have the potential to sway the market. From existing home sales to consumer confidence, new home sales, durable goods orders, and the ever-present jobless claims, the economic landscape is in flux. Adding to the intrigue is the two-day FOMC meeting, culminating in their highly anticipated announcement and prepared statements on Wednesday. To further compound the situation, the market’s reaction to the State of the Union address by the President of the United States will undoubtedly be a major factor to contend with.

In the face of such unpredictability, it is paramount to exercise prudent risk management at all times. Trade objectively and respond to the collective actions of traders across all timeframes. By staying informed and adapting to the prevailing market conditions, you can navigate the turbulent waters of today’s financial landscape with confidence.

Now that we’ve set the stage by emphasizing the significance of trends and the need for caution in the current market environment, let’s delve deeper into understanding why many traders inadvertently go against the trend, thereby diminishing their odds of success.

The Enigma of Trend Trading

“The trend is your friend” is a phrase that echoes through the annals of technical analysis. It’s a fundamental concept, and it’s been reiterated in countless books and publications. In our seminars, such as “Professional Trading Strategies” we devote entire chapters to dissecting the intricacies of trends and their pivotal role in most trading setups. Yet, despite the prominence of this adage, a significant number of traders persistently and subconsciously trade against the trend, thereby undermining their chances of success. Before we explore why this occurs, let’s establish a firm grasp of the basics of trends.

We all understand that security prices are determined by the delicate interplay between supply and demand. When one of these forces consistently outweighs the other, prices tend to move in a particular direction. Therefore, when demand persistently surpasses supply over an extended period, prices tend to ascend (and vice versa for situations where supply dominates demand). In technical terms, we refer to this phenomenon as a price trend. To capitalize on these price trends, technical traders have developed and honed a set of price patterns, known as setups, designed to exploit the inclination of prices to move in the direction of the prevailing trend. These setups are classified as “trend-following,” as they advocate taking positions in alignment with the trend’s direction. Of course, there are setups that enable traders to speculate on price movements contrary to the established trend (counter-trend). However, since prices in a trending environment usually spend the majority of their time following the trend, counter-trend strategies should be applied judiciously and under specific high-probability circumstances. So far, it all seems fairly straightforward, doesn’t it? Mechanically, it is. Nevertheless, there are factors that introduce complexity and can wreak havoc on traders’ performance.

The Psychological Quandary

Let’s first address the psychological challenges that traders encounter. It’s important to acknowledge that Newton’s Gravitational Law does not govern the markets. Traders tend to bring certain beliefs to the market that are unequivocally detrimental to their performance. They visualize a stock’s price as a rubber ball, expecting it to bounce back after a drop. There’s also a common perception that when something reaches “too high,” it must inevitably “come down.” Technical analysis inadvertently reinforces these beliefs through concepts like “overbought” and “oversold.” These mental constructs play tricks on traders’ minds, hindering their ability to objectively analyze price developments over time. Unfortunately, these beliefs often subconsciously influence trading decisions, leading to positions in stocks that swiftly move against them, resulting in unnecessary losses and psychological turmoil.

Navigating the Complexity of Trend Quality

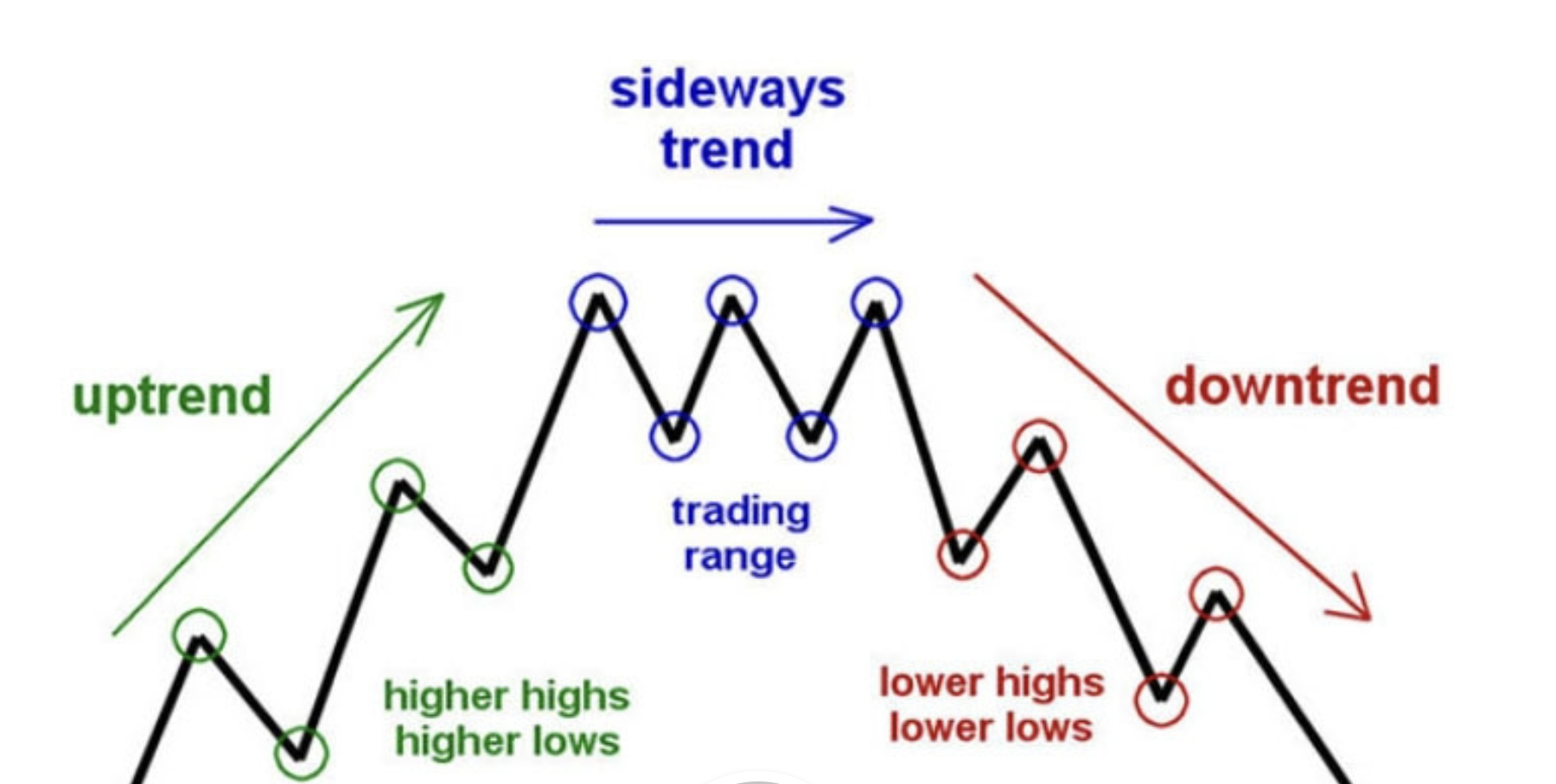

On the other side of the coin, we have the technical aspects of trends. Not all trends are created equal. Even when a stock exhibits a general directional bias, forming higher highs and higher lows (characteristic of a stage 2 uptrend) or lower highs and lower lows (typical of a stage 4 downtrend), it doesn’t necessarily qualify as a worthwhile trade. As previously mentioned, a trend is a visual representation of the ongoing tug-of-war between supply and demand. A high-quality trend reflects price action that unequivocally indicates one group’s clear dominance in the market. In such environments, setups tend to follow through in an orderly fashion. In contrast, low-quality trends lead to erratic price movements, resulting in frequent stop-outs due to the uncertainty that pervades such trends.

Choose Your Trades Wisely

Trading in harmony with the prevailing trend, as elaborated in PTS, represents the high-probability approach to navigating the markets (with some exceptions). When constructing your trading plan, be sure to specify the type of trend environment that suits your trade. Then, commit to executing trades exclusively within the confines of such high-quality trends. In my early days as a trader, I was determined to “show the market who’s boss.” I quickly learned that I had to let the market dictate the terms, not the other way around. Embrace this mindset, and you’ll witness tangible improvements in your trading performance.

In conclusion, the adage “The trend is your friend” is not just a catchy phrase – it’s a guiding principle that can elevate your trading game. However, it’s crucial to decipher high-quality trends from low-quality ones and avoid trading against the trend based on psychological biases. By choosing your trades wisely and aligning with the prevailing trend, you’ll enhance your odds of success in the ever-evolving world of trading.

Success in trading hinges on your ability to master your emotions, embrace a systematic approach, and continually refine your skills. With Live Traders as your guide, you can make the choice to be on the right side of your trades, consistently and confidently. So, remember, the trend is your friend, and with Live Traders by your side, your trading journey will be a rewarding and sustainable one. Join the Live Traders community and take your first step toward a brighter trading future.